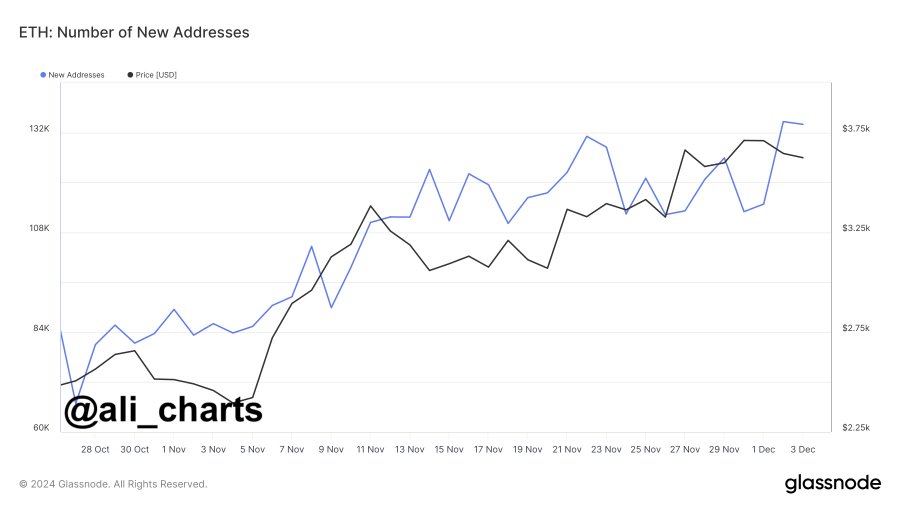

- Ethereum shows steady growth, adding 134,000 new ETH addresses daily, highlighting consistent adoption and activity.

- Major institutions like Itaú Unibanco and 21Shares are integrating Ethereum, signaling increased trust and mainstream adoption.

Ethereum’s rise continues to captivate the cryptocurrency world, as its path to $5,000 gains traction. Both analysts and market players are actively tracking the network’s constant uptake and growing use, which underlie these positive pricing estimates.

Far from mere speculative excitement, Ethereum’s value increase stems from institutional interest and actual implementation.

Rising Ethereum Adoption and Institutional Trust

With about 134,000 new ETH wallets added every day, on-chain analyst Ali Martinez recently noted the amazing expansion of Ethereum addresses. This consistent rise emphasizes the rising blockchain activity and curiosity.

Such acceptance is evidence of the platform’s durability and capacity to draw users even if the larger crypto market is still rather volatile. “This kind of expansion captures Ethereum’s strength as a top blockchain ecosystem,” Martinez said.

Ethereum remains the leading platform for staking and decentralized finance (DeFi), with $65.2 billion currently locked in DeFi systems. This big number shows the immense faith the society has in Ethereum’s ecosystem.

Moreover, some big financial companies are beginning to welcome Ethereum. One of the biggest banks in Brazil, Itaú Unibanco, has launched trading services for Bitcoin and Ethereum for more than 50 million users.

European players are also contributing to the accessibility of Ethereum. By cutting costs on two of its biggest Ethereum products, Swiss-based crypto ETP provider 21Shares made ETH more reasonably priced for investors to expose themselves to. This approach fits the general trend of democratizing chances for crypto investing.

Ethereum’s hosting of Standard Chartered’s tokenized money market fund marks still another important change. Projects like this show how Ethereum helps conventional finance adopt blockchain technologies.

According to CNF, together with projects like Libeara and regulatory clarity, tokenized assets are on route to reach a $30 trillion market by 2030. These developments underline Ethereum’s increasing impact outside of the crypto industry.

Investor sentiment is still positive. Driven by the strong network expansion and adoption statistics, popular crypto investor Jelle has voiced hope that ETH will surpass the $5,000 barrier. Jelle said, “Ethereum’s fundamentals are stronger than ever and the momentum is clear.”

Meanwhile, ETH is trading at $3,865.66 at the time of writing; it has gained 4.26% over the last 24 hours and 59.28% over the last 30 days.