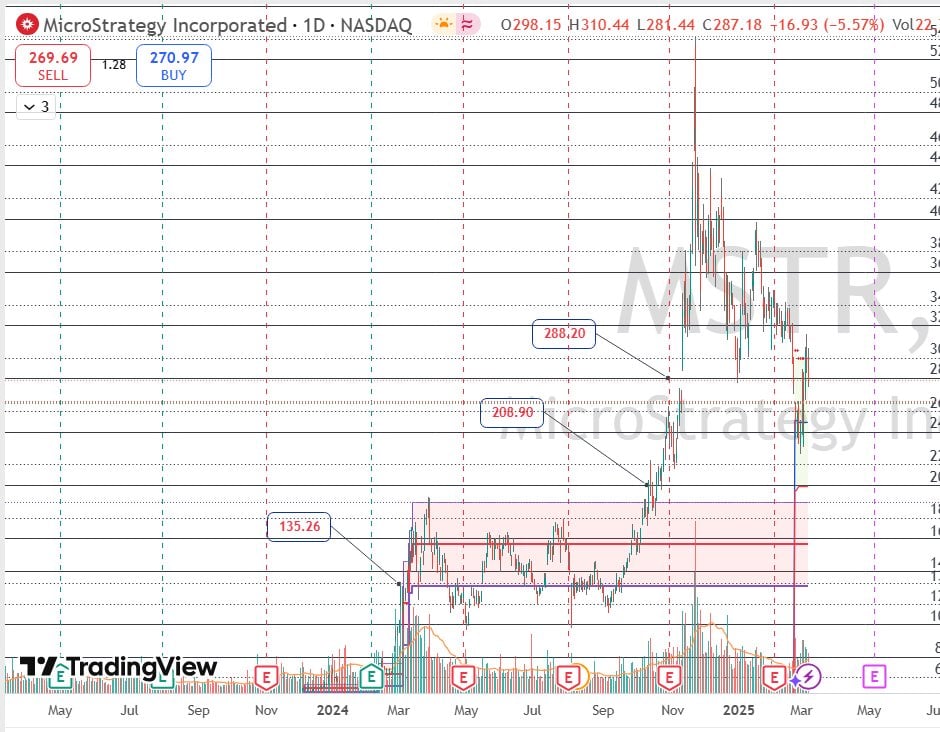

- MicroStrategy’s stock, MSTR, declined by almost 50% from its November high as a possible bearish continuation threatens Bitcoin’s (BTC) rebound.

- Bitcoin is currently struggling to hold above a crucial support level as analysts predict a possible decline to $60,000.

Business intelligence company MicroStrategy has witnessed its stock, MSTR, undergoing one of the worst moments in its history, having declined by 47% since November 2024.

Within the period, the asset has declined from $543 to $287.18. Fascinatingly, analysts believe that things could get worse once MSTR falls from the current position which is also a three months support level. A further breakdown could see MSTR falling to $248. Failure to hold above this level could see the asset finding support at $208. From this point, $135.26 could be the next support level.

Apart from the poor performance of its stock, MicroStrategy has recorded deteriorating earnings in four consecutive quarters. According to reports, a further decline in earnings and a subsequent breakdown of MSTR below $135 could force the company to sell its Bitcoin holdings.

MSTR’s Impact on the Bitcoin Price

As of February 24, 2025, MicroStrategy owned 499,096 Bitcoins at an average purchase price of $62,473.01 per unit and a total cost of $27.954 billion. According to analysts, selling a significant portion of this could impact the market.

Meanwhile, the Bitcoin price is moving in a similar line with the MSTR price as the asset recently declined from $94,204 to find support at the $90,320 level. Bulls could not sustain the price above this level as it further declined to $81k on March 9 before bouncing back to $83k.

Based on the historical price trend and market sentiments, Bitcoin could fall to its next major support at $75,884 once it plunges below the $81k level. A continuous move below this level could also see the asset finding another support within the psychological range of $72,000 – $70,000. Fascinatingly, its ultimate bearish target has been fixed at $65,000 – $60,000.

MSTR could also bounce back from this level and could drag Bitcoin along to $90,320 to re-establish a bullish momentum. Breaking above the $94,204 would also result in an uptrend. As featured in our recent analysis, crypto analyst Samson Mow believes that Bitcoin will hit $1 million in 2025.

In January 2025, MicroStrategy co-founder Michael Saylor announced that the company would issue a perpetual preferred stock and expand its Bitcoin-focused investment strategy, as detailed in our last news piece. Saylor highlighted that the company plans to offer returns and volatility at 1.5 times the levels of Bitcoin. However, the recent performance of the asset seems to be affecting expectations.

Amidst the backdrop of this, the company plans to raise another $21 billion for Bitcoin purchases.

Reasons for the MSTR and Bitcoin Price Decline

Investigating the reasons for the ongoing market trend, we found that the recent executive order signed by US President Donald Trump to create a national crypto stockpile could be a reason. According to research, most investors thought there would be “massive state-backed Bitcoin buys”; however, it turned out that no additional asset would be acquired, as noted in our earlier post.

The government will not acquire additional assets for the U.S. Digital Asset Stockpile beyond those obtained through forfeiture proceedings.