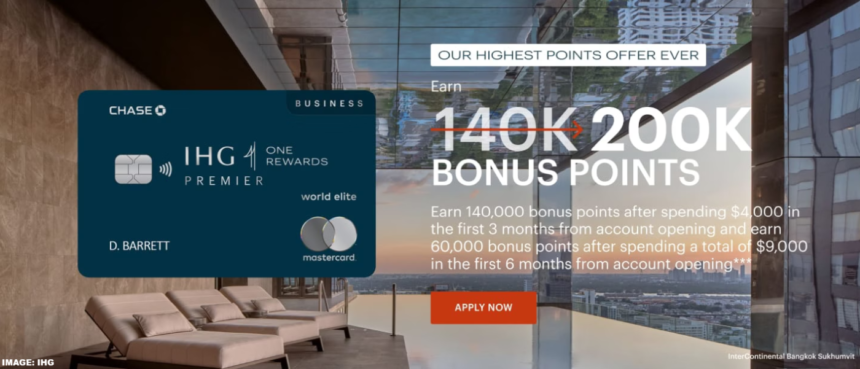

IHG and Chase launched an elevated sign-up offer for their cobranded business credit card on Friday, which is available through April 30, 2025.

The usual bonus is 140,000 points for spending $4K in the first 3 months, but new cardmembers can get an additional 60,000 points for a total spend of $9K within 6 months of account opening.

You can access IHG’s page for cobranded cards here.

READ MORE: IHG One Rewards Rate & Bonus Points Offers

The main benefit of IHG’s Chase cards is the fourth night free when redeeming points.

The Premier personal and business cards come with a yearly fee that is essentially offset by the free night cert, which is capped at 40K points (you can top it off with award points).

IHG’s Cobranded Cards with Chase:

IHG Premier Business Card:

Earning Points:

- Earn up to 26X total points at IHG Hotels & Resorts

- 10X points with this card***

- Up to 10X points from IHG on stays for being an IHG One Rewards Member***

- Up to 6X points from IHG on stays with Platinum Elite Status, a benefit of this card***

- Earn 5X points on travel and dining

- Earn 5X points for every dollar spent on travel and hotels***

- Earn 5X points for every dollar spent at gas stations***

- Earn 5X points for every dollar spent at restaurants, including takeout and eligible delivery***

- Earn 5X points on select business expenses

- Earn 5X points for every dollar spent on social media and search engine advertising, and office supply stores***

- Earn 3X points for every dollar spent on all other purchases***

Benefits:

IHG One Rewards Program exclusives

- Automatic Platinum Elite Status for as long as you have the IHG One Rewards Premier Business Credit Card***

- Redeem 3 nights and get the 4th night free***

- Anniversary Free Night (current point redemption cap of 40,000) with the ability to add points from your IHG One Rewards account to redeem at hotels above the 40,000 point redemption level***

- Save 20% on point purchases when you purchase points with your card***

- Early access to IHG Reward Night sales as an IHG One Rewards Cardmember***

Annual Spend Rewards

- Earn a $100 statement credit and 10,000 bonus points after spending $20,000 each calendar year***

- The primary Cardmember will earn Diamond Elite status through December 31st of the following year after spending $40,000 each calendar year***

- Earn an additional Free Night with a current point redemption cap of 40,000 points after spending $60,000 on your IHG One Rewards Credit Card each calendar year***

Travel

- Global Entry, TSA PreCheck® or NEXUS fee statement credit of up to $120 every four years***

- Receive up to $50 United® Airlines TravelBank Cash each year***

- No foreign transaction fees†††

- Cardmember events

- Unique events and Priceless® experiences just for Cardmembers

Conclusion

If you are eligible for credit cards in the US and stay at IHG-affiliated hotels, you should probably have one of these three co-branded cards (if not for anything else) to get the fourth-night free award benefit.

The Premier cards are good for IHG spending, as you earn an additional 10 points per USD (if the hotel is correctly identified as IHG at Chase’s end—and many are not).

Using them for any other purpose makes little sense, however, as there are better and higher-earning products for those.

The elevated signup offer requires you to spend another $5K with this card over the $4K to get the base bonus of 140K.

IHG awards are dynamic, and their top-tier hotels require over 200,000 points per night.