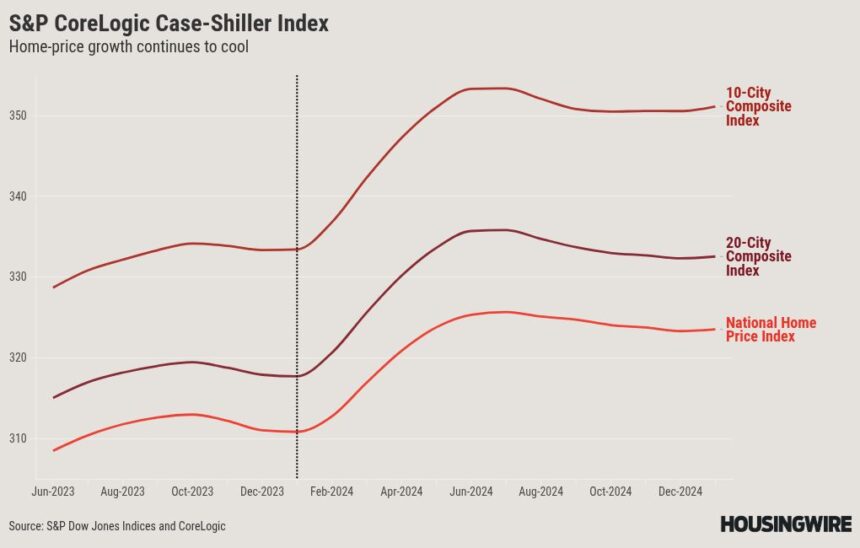

Home prices accelerated in January, but the pace remains below its recent peak.

According to the S&P CoreLogic Case-Shiller Home Price Index, home prices rose by 4.1% compared to this time last year, a slight uptick from the 3.9% recorded in December. The month-over-month gain was 0.6%.

The falling rate of annual home-price increases is a trend that occurred throughout 2024, which peaked last February at 6.6%. It’s also significantly lower than the double-digit increases from 2022, when price appreciation hit 20% or more multiple times.

“Higher mortgage rates, along with high home prices, have exacerbated affordability challenges and led to slower home price appreciation,” said Bright MLS Chief Economist Lisa Sturtevant in a statement. “Even as mortgage rates come down, it is likely that home prices will not grow as fast this year as they have over the past couple of years. More inventory has been coming onto the market, which gives buyers more leverage and room for negotiation.”

The index’s city composites showed quicker home-price appreciation than nationally, suggesting that prices in cities are outpacing less dense parts of the country. The 10-city composite rose by 5.3% and the 20-city index jumped 4.7%.

The New York (7.75%) and Chicago (7.52%) metropolitan areas led the country in year-over-year gains, with Boston (6.55%) and Cleveland (6.45%) not far behind. Dallas (1.34%) and Denver (1.87%) registered annual rises less than 2%, and Tampa turned negative annually with a 1.5% drop.

But the month-over-month changes show home prices coming down. Eleven of the cities in the 20-city composite fell in January relative to December, with Tampa (0.6%) leading the way. It’s a continuation of the monthly trend in December, when 14 of the cities dropped monthly.

Housing inventory for sale has been rising dramatically in recent months, which has softened markets across the country, particularly those where inventory has risen by as much as 40% year-over-year.

But so far the rise in inventory hasn’t resulted in a spike in home sales. This is likely due to a number of factors facing potential homebuyers, including persistently high mortgage rates, affordability that remains strained and uncertainty around the economic policies of President Donald Trump, which have caused world markets to drop.

“Without mortgage rate or home price relief, housing affordability is now a binding barrier to most potential home buyers, especially for those buying for the first time and unable to capitalize on these continually appreciating home prices,” said Zillow Chief Economist Skylar Olsen. “Such appreciation is evidence that not all buyers are held back, however.”