The number of home flips across the U.S. fell in 2024, continuing a downward trend as real estate investors grapple with tight profit margins.

According to Attom’s 2024 U.S. Home Flipping Report, investors flipped 297,885 single-family homes and condominiums last year. That marked a 7.7% decline from 2023 and a 32.4% decline from the recent peak of nearly 441,000 flips in 2022.

As flipping activity slowed, the share of flips among all home sales also dipped from 8.1% in 2023 to 7.6% in 2024. But a silver lining emerged as gross profits inched up to $72,000 per flip, up from $67,846 the previous year. This translated into a 29.6% return on investment (ROI) compared to the original purchase price, up slightly from 28.6% in 2023.

“The home-flipping industry saw investors shy away even more in 2024 amid the extended period of languishing profits. But even as activity waned, there was at least a glimmer of hope that returns were starting to turn around,” Attom CEO Rob Barber said in the report.

Flips decline in two-third of US metros

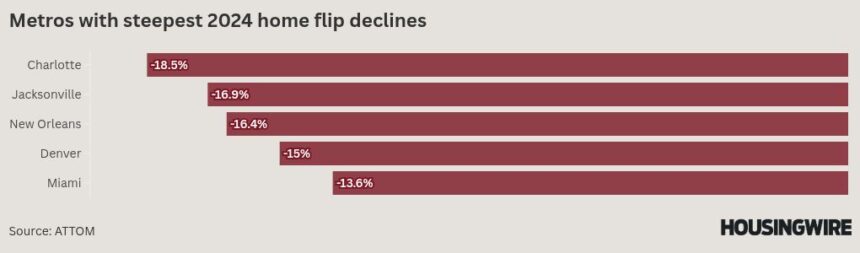

Home flips declined in 145 of 213 metro areas (68%) analyzed in the report, with the biggest slowdowns seen in the South and West.

Major metro areas with the steepest declines included Charlotte (-18.5%), Jacksonville (-16.9%), New Orleans (-16.4%), Denver (-15%) and Miami (-13.6%).

Conversely, a handful of smaller markets saw an uptick in flipping activity. Cedar Rapids, Iowa, led the way with a 49.6% increase. It was followed by Bellingham, Washington (+28.2%); Warner Robins, Georgia (+26.8%); Merced, California (+24.5%); and Norwich, Connecticut (+23.4%).

The fourth quarter of 2024 saw 69,929 home flips completed by 54,502 investors, an average of 1.28 flips per investor. Flips purchased with financing accounted for 36.2% of transactions, holding steady from the previous quarter but down from 37.3% a year earlier. Meanwhile, 63.2% of flipped homes were bought with cash, a slight increase from 62.2% the previous year.

Among major metros, San Diego (59%), Seattle (58.1%), and Fresno, California (50.6%) had the highest percentage of flips purchased with financing. On the other hand, Buffalo, New York (81%), Cleveland (77.4%) and Detroit (76.5%) had the highest share of all-cash purchases.

Profit margins rise in some locations

Even as gross flipping profits remained lower than in past years, they climbed in 141 of 213 metro areas analyzed (66%).

San Jose ($283,000), San Francisco ($218,000) and New York City ($175,000) recorded the highest gross profits in 2024. The Texas metros of Austin ($8,844) and San Antonio ($17,832) saw the smallest profits.

On a percentage basis, the biggest ROI gains were in Cleveland, where margins jumped from 39.2% in 2023 to 72% in 2024. Buffalo saw an increase from 83.9% to 109.1%, while St. Louis improved from 34% to 45.1%.

But some metro areas saw large declines in ROI, including Philadelphia (82.4% to 68.4%); Hartford, Connecticut (59% to 45.7%); and Detroit (66.7% to 59.2%).

Flips are moving more quickly

The average time to complete a home flip in 2024 was 162 days, down slightly from 169 days in 2023. Additionally, the share of flipped homes sold to buyers using Federal Housing Administration (FHA) loans remained steady at 10.7%.

The top market for FHA buyer activity was Merced, California, where 38.3% of the flipped homes were resold to buyers using FHA financing. Lakeland, Florida (27%), and Bakersfield, California (25.9%), were next on the list.

Despite the mild growth in ROI, profit margins for home flips remain far below their 2016 peak of 54.2%. Investors are struggling to capitalize on rising home prices amid a higher mortgage rate environment, fewer foreclosure listings to choose from and general economic uncertainty.

“This year poses significant uncertainty for investors, what with a short supply of homes for sale, declining numbers of low-priced foreclosure properties, mixed economic forecasts, and elevated mortgage rates,” he said. “So, they will have to do some very smart buying and quick renovating to keep the profit rebound going.”