Home prices firmed up in today’s existing home sales report, but we caught on to this trend two months ago with our Housing Market Tracker. Traditionally, home prices soften in the second half of the year and I had counted on this for my price forecast, which predicted 2.33% home-price growth for 2024. However, that didn’t happen.

The difference is mortgage rates: even with inventory growing at a healthy clip this year, mortgage rates just heading down toward 6% for a brief period of time resulted in higher prices in a seasonally soft period.

From the National Association of Realtors: Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – expanded 3.4% from September to a seasonally adjusted annual rate of 3.96 million in October. Year-over-year, sales progressed 2.9% (up from 3.85 million in October 2023).

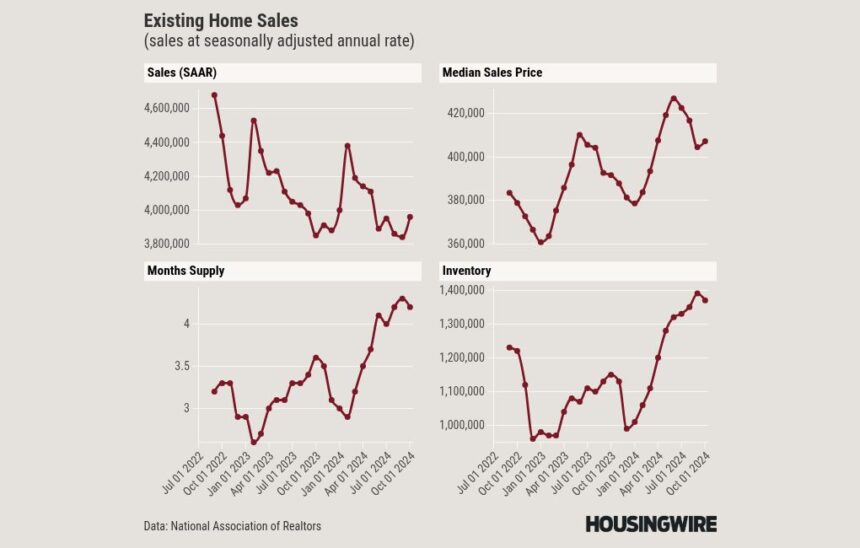

The charts below show the key data lines from the NAR existing home sales report. Remember that we track housing data differently than the NAR, but these are the big four from their report.

As part of our tracker, we focus on purchase application data, and I am always looking to see what level of mortgage rates gives us growth in purchase apps. When mortgage rates increased to 7.50% earlier in the year, purchase apps were very negative on the week-to-week data line. In fact, we had 14 negative weekly prints compared to two positive prints.

However, once rates started to fall in June, this is what the next 18 weeks looked like:

- 12 positive prints

- 5 negative prints

- 1 flat print

Since September after the Federal Reserve cut the Fed funds rate, mortgage rates have risen from 6% to 7%, but we saw good weekly growth in the data lines before that. Remember, purchase application data takes about 30-90 days to hit the existing home sales report. We can track demand faster with our weekly pending contract prints, so it shouldn’t have been a surprise that we had some growth in today’s report. I discussed this on Yahoo Finance this morning.

Home prices

As you can see below in our weekly tracker data, home prices were firming up in October, which really surprised me: I didn’t anticipate lower mortgage rates would have changed the data line so much. However, they did, and this is the second time over the past two years that mortgage rates just heading toward 6% changed housing market dynamics. This is something to think about for 2025.

If you connect the dots with our weekly tracker data, it shouldn’t be surprising that housing demand picked up. We connect the economic data daily and weekly and don’t wait for monthly reports. Home prices firming up with higher inventory and mortgage rates just getting toward 6% is a lesson learned in 2024 for 2025.