Among the suite of Delta co-branded credit cards, the *delta reserve card* is the top dog – and that alone is enough to convince many Delta loyalists that they need it. It unlocks the biggest SkyMiles bonus, an annual companion certificate, a head start on earning Delta status – plus more Medallion Qualifying Dollars (MQDs) for your spend – more Delta Sky Club® access than you’ll get from any card, and more.

No question, Delta’s Reserve card comes with more perks than any other Delta credit card. But that doesn’t mean the Delta SkyMiles Reserve Card is right for you – even if you’re a diehard Delta flyer on the hunt for a top-of-the-line travel card.

Sure, the Reserve Card can easily make sense for road warriors flying constantly for work and chasing Delta Medallion status. But many flyers will be better off with one of the other Delta co-branded cards … or maybe even not even having a Delta Card at all.

The Basics of the Delta SkyMiles® Reserve American Express Card

There’s no question the Delta Reserve Card brings a lot to the table. Here’s a full look:

Delta SkyMiles® Reserve American Express Card

- bonus_miles_full

- Check your first bag free on every Delta flight – savings of at least $60 on each round-trip flight, per person

- Priority boarding (even with a basic economy ticket)

- Get 15 Delta Sky Club visits per year between Feb. 1 and Jan. 31. You can unlock unlimited Sky Club access if you spend $75,000 or more on your card in a calendar year.

- You also get four free guest passes and can bring up to two guests in at a time. After that, each guest visit will cost an additional $50.

- Complimentary access to the American Express Centurion Lounges when you are flying Delta on a ticket purchased with your Reserve card

- Get an economy, Delta Comfort Plus, and first class companion certificate to destinations throughout the U.S. (including Hawaii, Alaska, the U.S. Virgin Islands and Puerto Rico) as well as many destinations in Mexico, the Caribbean, and Central America, each year upon card renewal

- MQD Headstart: Get a head start on earning Medallion status with an automatic 2,500 Medallion Qualifying Dollars (MQDs) each year

- Earn 1 MQD for every $10 you spend on your card

- Earn 3x SkyMiles per dollar spent on Delta purchases

- Earn 1x SkyMiles per dollar spent on all other eligible purchases

- Up to a $200 Delta Stays credit: Earn up to $200 in statement credits each year when you make a Delta Stays prepaid hotel or vacation rental booking on the Delta Stays platform.

- Up to a $120 Rideshare Credit: Get up to $120 in statement credits (doled out in $10 monthly installments) a year when you use your card to pay for a ride with Uber, Lyft, Curb, Revel, or Alto in the U.S.

- Up to a $240 Resy Credit: Get up to $240 in statement credits each year (doled out in $20 chunks each month) when you use your card to pay for eligible purchases on Resy, Amex’s restaurant reservation platform. This is also a use-it-or-lose-it benefit: Any unused balance won’t roll over to the following month.

- Get up to a $120 credit to cover the cost for Global Entry or TSA PreCheck once every 4.5 years for the application fee for TSA PreCheck® and every 4 years for Global Entry

- Complimentary space-available upgrades, even for non-Medallion members. A great way to improve your upgrade chances.

- Get 15% off SkyMiles award tickets with TakeOff 15 when booking on delta.com or through the Fly Delta app

- Hertz President’s Circle Status: Receive complimentary top-tier Hertz President’s Circle elite status upon enrollment.

- Enjoy 20% off in-flight purchases such as food & drinks in the form of a statement credit

- No foreign transaction fees

- $650 annual fee (See rates & fees)

Learn more about the *delta reserve card*.

Chasing Elite Status

For most people, the real value of the Delta Reserve Card is to level up their Delta Medallion status. But it’s not enough to fly a lot with the airline – now more than ever, you also need to spend a lot.

Before we dive into the specifics of earning Medallion status with the Delta Reserve card, let’s set one thing straight: Chasing elite status is rarely worth it – most travelers are far better off as elite status free agents.

The amount of spending required to earn Delta’s top-tier Diamond Medallion status is unreasonably high. However, if you already spend a ton of time on planes – preferably on your employer’s dime – there’s no doubt that having elite status will make your travel experience more enjoyable. And the Delta Reserve card can help you vault even higher.

Here’s how the Delta Reserve can help.

How to Earn Medallion Status

After turning some of its most loyal flyers against the airline with sweeping and painful changes to earning Medallion Status at the end of 2023, earning Delta status is a whole new world.

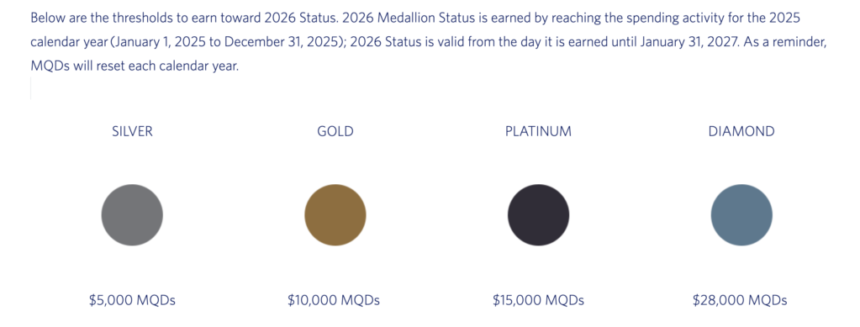

Nowadays, earning any level of Delta Medallion status is largely about how much you spend with the airline, and that is measured through Medallion Qualifying Dollars (MQDs). And from the lowest tier to the top, you’ll have to spend a lot to earn status.

You’ll earn $1 MQD per $1 spent on Delta flights. You’ll also earn $1 MQD for every $10 spent on the *delta reserve card*, and $1 MQD for every $20 spent on the *delta skymiles platinum card*.

However, to ease the pain of reaching these spending requirements, Delta offers an MQD headstart on both the Delta SkyMiles Reserve and Platinum Cards (and their small business counterparts). With this MQD boost, the airline doles out 2,500 MQDs to travelers at the beginning of each year.

That means if you’ve got the Delta Reserve or Platinum Card in your wallet at the start of the year, you’ll get 2,500 MQDs right off the bat – half of what it takes to reach Silver Medallion status. And since you’ll earn $1 MQD for every $10 spent on the Reserve Card, you could spend $25,000 on your card in a calendar year to meet the $5,000 MQD requirement to earn the lowest level Silver status without setting foot on a Delta plane.

Since the Delta Platinum Card earns $1 MQD for every $20 spent on the card, you’d need to spend twice as much ($50,000) to earn the additional $2,500 MQDs to earn Silver status. So like it or not, holding the Reserve Card is practically a requirement if earning Delta status is your goal. Critically, you won’t earn any MQDs whatsoever by spending on the *delta skymiles gold card* or the *delta blue*.

While we often question whether earning status with Delta (or any airline is worth it), holding the Reserve Card is the path of least resistance if you want Medallion status.

Is Delta Status Really Worth It?

If all this status talk is making your head spin or you’re not following how to earn MQDs (or why they matter), then the Delta Reserve Card is not for you.

Of course, Delta Medallion Status can be quite nice. You’ll have a chance at complimentary upgrades – though these days, that’s gotten less and less likely as the ranks of Medallion Status members have grown and Delta continues to sell more and more first class seats outright. Other status perks include access to waived baggage fees, priority boarding, and more.

But do you really fly enough to make use of those perks? Is it worth spending so much on one single credit card, foregoing bigger (and better) bonuses on other travel cards? Unless you’re a true Delta road warrior, traveling multiple weeks per month, the answer is probably no.

All that means you should likely look past the Delta SkyMiles Reserve Card – especially if what you really want is access to the Delta Sky Club and other airport lounges.

Lounge Access

Status may not be your goal, but the Delta Reserve Card is also powerful if you want to hit the Delta Sky Club after your flight.

There’s good and bad news there. As of earlier this year, you no longer get unlimited access: Reserve cardholders are now limited to 15 Sky Club visits each year unless they spend $75,000 on their card in a calendar year, which then unlocks unlimited Sky Club access. But unless you’re also planning to spend that much to earn elite status, it likely isn’t worth it.

That 15-visit allotment is five more than you get with *amex platinum* each year. Any trips into multiple Sky Clubs in a 24-hour period count as one visit, so hopping into several Delta lounges before departure and again during a connection won’t cost you two visits.

While some Delta lounges are better than others, they all provide a nice place to relax (or work) away from the hustle and bustle of a crowded terminal. In general, you can expect to get complimentary food and drinks, comfortable seating, and free Wi-Fi. Some outposts, like the relatively new Sky Clubs at Chicago-O’Hare (ORD) and Los Angeles (LAX), even include shower suites, where you can freshen up before or after your flight and lean heavily on local influences with specially curated menu items and design touches.

Reserve cardholders also get four free, one-time guest passes for the Sky Club to bring in a friend or family member. After that, you’ll have to pay $50 each for up to two guests at a time.

Related Reading: The Definitive List of the 8 Best Delta Sky Clubs

What About Upgrades?

On paper, the Reserve Card gives non-Medallion status holders some elite-like perks with access to Complimentary space-available upgrades. This benefit gives Reserve Cardholders the chance to get bumped to First Class and Delta Comfort Plus – even without any level of elite status. Who doesn’t want a free upgrade to the front of the plane?

We hate to break it to you: In practice, that’s not going to happen. You need to put the emphasis on the words “space-available” on this perk.

Delta determines its Medallion upgrade order based on a series of factors. And while holding the Reserve card can be a decent tiebreaker if you’ve already got Medallion status, it will almost never be enough to secure you an upgrade to first class on its own – especially as travel demand and elite status ranks have grown following the pandemic.

Here’s the current hierarchy of who gets first dibs on a free upgrade:

- Delta Medallion Status level: Diamonds get precedence over Platinums, Platinums over Golds, etc.

- Cabin Purchased: (Original + Paid Upgrades)

- Million Miler status members have slightly better odds at an upgrade than others.

- Delta SkyMiles Reserve Card: A Platinum Medallion member with a Reserve Card in their wallet gets precedence over another Platinum member who bought the same fare type

- Delta Corporate Travelers get a slight edge over everyday Medallion members.

- Medallion Qualification Dollars (MQDs) earned in the current calendar year

- Date and time of upgrade request: Buying your ticket earlier than someone whose odds are otherwise equal can give you the final nod for the free seat.

Regardless, all those factors make it highly, highly unlikely you’ll score a first class upgrade with a Reserve card alone. What’s more, Delta is increasingly selling these first class seats to paying customers rather than holding them for complimentary upgrades. That has made it hard for even top Delta elites with a Reserve card to count on a complimentary upgrade.

Case in point: Just over a decade ago, the Atlanta-based airline was selling less than 10% of first class seats, filling the rest of the seats up front with Medallion members via complimentary upgrades. But Delta President Glen Hauenstein told investors late last year that it’s now selling a whopping 88% of first class seats, leaving just 12% of the cabin available for upgrades.

So even if you have top Delta Diamond Medallion status and hold the Delta Reserve Card, if you want status for complementary upgrades, the calculus is getting harder and harder to justify.

Read more: Why Delta Medallions Can (Almost) Never Count on Free Upgrades Now

Grab The Platinum Card® from American Express Instead

Nine out of 10 travelers who think they need a Delta SkyMiles Reserve Card might be better off with a different travel card. And Delta’s name isn’t on it.

It’s *amex platinum*, the top-tier travel card in the American Express portfolio – not to be confused with the *delta skymiles platinum card*. While it isn’t a Delta co-branded card, it can still get you major benefits when flying with Delta – and a way to earn SkyMiles, too.

When it comes to lounge access, no card can match what the Platinum Card offers. You’ll get 10 complimentary visits to the Delta Sky Club each year. While that’s five fewer visits than you’ll get with the Delta Reserve Card, but there is a small workaround to turn that into 14 annual visits by using the up to $200 annual airline credit you’ll get with the card.

Just like with the Reserve Card, you can restore unlimited complimentary visits by spending $75,000 each calendar year … but with The Platinum Card, there’s an added bonus. Spending $75,000 also allows you to bring free guests to the American Express Centurion Lounges, no matter which airline you’re flying with.

But the real value of the Platinum Card is that your lounge access goes even further: American Express calls it the Amex Global Lounge Collection.

Your Platinum card will get you into smaller lounge networks like Plaza Premium, Airspace, and Escape Lounges – including our go-to lounge at Minneapolis-St. Paul (MSP) (which is also an option on the Delta Reserve Card as long as you are flying Delta). Finally, the Amex Platinum also includes a complimentary membership to Priority Pass – opening the doors to more than 1,400 additional lounges across the globe for you and up to two guests.

You’ll also get a ton of annual credits to help offset the card’s $695 annual fee (see rates & fees). Seriously, the Amex Platinum has so many benefits, it’s tough to keep it all straight.

Here are some highlights:

- You’ll get up to $100 each year to spend at Sak’s Fifth Avenue

- Up to $200 each year to use at Uber or on Uber Eats food delivery

- Up to $200 in Amex airline fee credits

- Up to $200 toward hotels booked through Amex Travel (a minimum two-night stay is required for Hotel Collection bookings)

- Up to $199 a year to cover CLEAR® Plus

- Up to $240 in digital entertainment credit

- And several more.

Simply put: Unless you’re chasing Delta elite status, you’ll get much more out of The Platinum Card for a similar annual fee.

The Platinum Card earns American Express Membership Rewards points, which can be transferred directly into your Delta SkyMiles account. Or better yet, they can be moved to Amex’s more than 20 other airline and hotel partners to be used for an award redemption – making them much more valuable than SkyMiles alone.

Learn more about *amex platinum*.

Read more: The Best Ways to Use Amex Membership Rewards Points

Bottom Line

The Delta Reserve Card is Delta’s ultra-premium, co-branded credit card that comes packed with perks for loyal Delta Flyers. These perks make it a desirable card for those chasing Delta status … if that is your goal.

But the truth is that unless you’re on the hunt for Delta Medallion elite status, the Reserve Card likely isn’t for you. Most travelers will be better served with a lower-priced Delta card like the *delta skymiles gold card*.

And even if your primary reason for getting the Reserve Card is Sky Club access, The Platinum Card from American Express might be a better option altogether.