- A potential PI Coin unlock has triggered caution among investors and early backers.

- Concerns loom due to a potential projection to drop below $1; however, the growing PI use case can serve as a cushion.

The Pi Network’s native digital asset, Pi Coin (PI), trades slightly below $1.4 amid a massive broader sell-off. At the same time, many investors have decided to stay on the sidelines ahead of the upcoming token unlocks. This event can trigger a Pi Coin crash ahead, but experts remain optimistic, especially with anticipations over a potential Binance listing.

Pi Coin Price Outlook

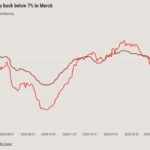

The price of Pi Coin is down 4.5% on the daily charts and exchanging hands at $1.36. The daily trading volume is also down 50.8% to $494.2 million. Pi Coin touched a daily high and low of $1.45 and $1.30, respectively. The cryptocurrency has lost over 21% of its value over the last seven days and 19% since its launch on February 20.

Despite the recent downturn, PI defied the broader market sell-off trend. For context, Bitcoin plummeted nearly 2.3%, with recent reports indicating a potential crash to $70,000 ahead. Also, Ethereum (ETH) is down over 8% today, suggesting investors waning interest in risky assets.

In just a few days after its launch, adoption for Pi Coin has soared, with more users talking about the digital asset. Real estate firm Zito Realty LLC now accepts PI as a payment option, further strengthening market confidence.

Despite these positive developments, market players remain skeptical due to an unlock event on the horizon. Data from PiScan reveals an average daily token unlocks reaching 9.05 billion Pi, valued at $12.4 billion. The upcoming token unlock is expected to increase the supply substantially.

The unlock event on March 17 and 21 will release 23.1 million PI and 23.4 million PI, respectively. Over the next 30 days, 271.68 million PI, worth $543.36 million, will go into circulation courtesy of the unlock event.

Potential Impact of PI Unlock

The influx of new tokens could increase selling pressure, potentially driving the price below $1. This scenario follows the principle of economics, which states that an increase in supply without a corresponding demand will drive prices down. With this in mind, traders exercise caution and hesitate to invest ahead of the unlock event.

Analysts claim PI could drop below the $1 psychological level if PI fails to withstand the selling pressure. Despite the pessimistic outlook, market participants keep tabs on the coin amid soaring expectations of a Binance listing. As reported last week, 86% of users have already voted in favor of the Binance listing PI, fueling market optimism. If this listing happens, it can boost the price of the digital currency.

PI is currently ranked the 11th-biggest cryptocurrency by market capitalization, demonstrating its soaring user base and adoption. Meanwhile, as noted in our earlier post, Binance recently introduced a game-changing listing model, potentially opening the door for Pi Coin.