- Avalanche (AVAX) has been predicted to extend its downward trend if bulls fail to seize control to force a rebound from the current position.

- Multiple on-chain metrics indicate that the asset is undergoing a bearish run, with 80% of AVAX holders reported to be at a loss.

Avalanche (AVAX) has slumped below a crucial support level at $19, as it prints negative returns across all the notable trading periods. In the last 24 hours, the asset has declined by 5% to trade at $18.79. Fascinatingly, this has extended its weekly loss to 19%, the monthly loss to 22%, and the 90-day loss to 60%.

Subjecting the asset to critical analysis, analysts observed that AVAX is forming a symmetrical triangle pattern where both buyers and sellers appear indecisive in the market. Meanwhile, a possible break above the upper boundary of the triangle could lead to a short-term rally. However, failure to hold above the current level could see AVAX experiencing a deeper correction and finding support at the lower point of the price curve.

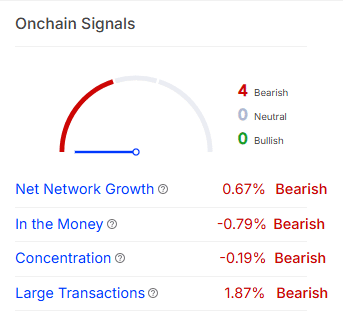

Delving into the asset’s on-chain activities, we found that AVAX appears more bearish than bullish as the network growth declines by 0.67%. Additionally, the “In the Money” metric falls by 0.79%. Technically, this implies that only a few investors are in profit.

Exploring other metrics, we also found that the concentration metric was “sitting” at -0.19%. According to our analysts’ interpretation, this implies that the distribution of the token has experienced little change. Meanwhile, whale activities have significantly dropped as well. Based on the data, large transactions have decreased by 1.87%.

More About Avalanche’s (AVAX) On-chain Activities

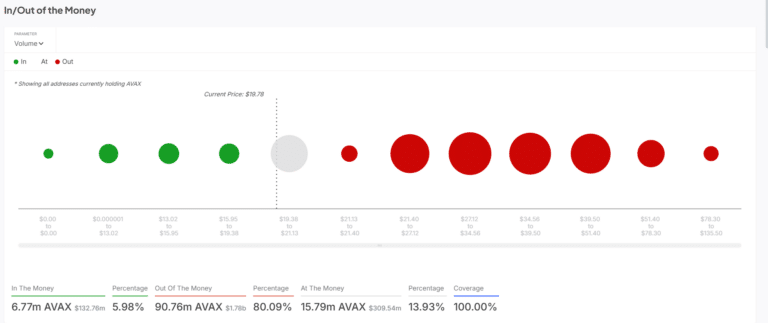

Looking into the in/out of the money chart, we further discovered that 80.09% of addresses holding AVAX are at a loss, confirming the bearish market situation. When the asset was trading at $19, only 5.98% were reported to be at a profit. According to analysts, the latest decline below $19 indicates that many investors may be tempted to sell to cut their losses.

AVAX’s struggling performance could be traced back to the last quarter of 2024 after it rallied to a significant level. In December, the asset took a huge nosedive to lose all the gains made in November.

As of February 21, the asset was down by 31% on the year-to-date chart, while its market cap stood at $10.56 billion. Based on our market data, AVAX has declined further from that period as the market cap currently stands at $7.48 billion while its year-to-date gains declined by 51%. Meanwhile, an analyst identified as KALEO predicted on November 11 that the asset would hit $50 in the following two days.

Avalanche’s disappointing turnout, however, has not discouraged enthusiasts from remaining bullish. As we discussed earlier, it recently became the third most mentioned Real-World Asset (RWA) token on social media, just behind Chainlink (LINK) and Hedera (HBAR). According to the data, AVAX was mentioned 7.42k times.

Avalanche was also named as the next crypto that could benefit from the US crypto strategy apart from BTC, ETH, XRP, ADA, and SOL. As highlighted in our previous article, the asset was said to be part of the few tokens that were made in the US, has an ETF application pending, and is part of the projects whose representatives have participated in a White House meeting. Prior to that, it had emerged as one of the few RWA assets with the most social engagement in February, as outlined in our recent blog post.