It always hurts to see how much you would have brought home if it weren’t for taxes – but believe it or not, there’s a bright side to all this.

What do I mean? Your annual income tax bill could be your ticket to earning valuable credit card points and airline miles.

While paying federal income taxes the old-fashioned way (with cash) will no doubt be easiest for some, those who are willing to put in a little extra work (and pay a nominal fee) can score a bunch of points and miles by paying taxes with a credit card instead. With tax documents starting to hit mailboxes, now is the time to decide whether or not paying your bill with a card (and which one) makes sense for you.

We’ll run through the basics of paying your tax bills with a credit card and when it might make the most sense.

Read next: 4 Credit Card Myths You Should Stop Believing

Will I Have to Pay a Service Fee?

Let’s get this out of the way: Paying taxes with a credit card isn’t free. But it can easily be worth it if you play your (credit) cards right.

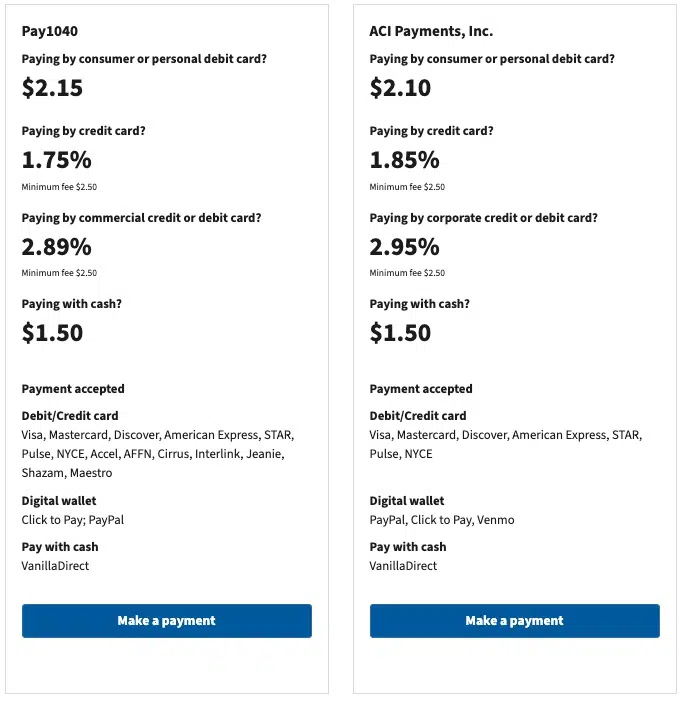

Processing fees for paying your taxes with a credit card will vary by service provider. According to the IRS website, the current best deal for this service is offered by Pay1040, which charges a 1.75% convenience fee (minimum $2.50 fee) when you pay with a credit card. Meanwhile ACI Payments, Inc. charges a 1.85% fee (minimum $2.50 fee).

While a 0.1% savings by using Pay1040 might not sound like a big deal, it can make a difference if you owe a decent amount of money come tax season. And since both services accept major credit cards from Visa, American Express, Discover, MasterCard, etc. Pay1040 should be your choice for the lowest cost.

Across the board, fees are down from last year, meaning there’s never been a better time to pay your taxes by credit card. Unfortunately, we have one less processor to choose from this year – payUSAtax was previously listed on the IRS site, but that’s no longer the case.

When Should You Pay Taxes with a Credit Card?

If you owe the IRS money come tax time, you might be able to come out ahead on your payment – even with paying the 1.75% processing fee.

The absolute best way to do it is by putting your tax bill on a brand new credit card to earn a big welcome offer points or miles bonus. It’s one of the easiest ways to hit the minimum spend requirement on a new credit card, depending on the size of your tax bill. Charge it to your new card, then pay it off immediately with the money you have saved up to cover your tax burden.

For example, the *venture x* is currently offering a 75,000-mile bonus after you spend $4,000 on your card in the first three months of card membership. That alone is worth a minimum of $750 towards travel – or potentially much more when using Capital One transfer partners.

Let’s say you have an upcoming tax bill of $5,000. Using Pay1040 you would incur a fee of $87.50 ($5,000 x 1.75% processing fee) for using your card. But because the Venture X earns 2x miles on all purchases, your $5,000 tax payment would earn you 10,000 Capital One miles worth a minimum of $100 towards travel (more than the fee). Once you take into account the card’s 75,000-mile bonus offer, you’d earn at least $850 worth of travel for making your tax payment!

It’s not a bad tradeoff, all things considered.

Learn more about the *venture x*.

A few American Express credit cards could be another strong option – especially if you can get a whopping 175,000-point welcome offer on *amex platinum* via CardMatch or from a friend’s referral link. The same goes for the *amex gold*: If you can get a big welcome offer through CardMatch or a personal referral link, using either of these cards to pay your taxes would be a no-brainer as the value of those points easily outweighs the extra fee when paying taxes with a card.

Thrifty Tip: You can also pay part of your taxes with a credit card and the rest with cash. That means you can put just enough to meet a minimum spending requirement on your credit card and pay the rest with cash without incurring an extra fee.

Make sure to check out our Top Credit Cards Page to see all the best current offers.

When You Shouldn’t Use A Credit Card to Pay Taxes

We love points and miles, but paying taxes with a credit card won’t be right for everyone.

For starters, if you carry a balance on your credit card, the interest you’ll pay will vastly outweigh the value of any credit card rewards you’d earn. We do not recommend paying your taxes with a credit card in this situation. Instead, you’ll be better off putting any extra money towards your outstanding card balance and avoiding any additional debt.

Even if you’re not in debt, it won’t always make sense to use a credit card to pay taxes – especially if you aren’t working towards a minimum spending requirement on a new card. Since a lot of cards only offer 1x points (or miles) in non-bonus categories, like these tax payments, the points you’re earning likely won’t be valuable enough to offset the cost of that 1.75% fee. There are exceptions to this, of course. But it’s a good rule of thumb.

So, if you’re not working on a big new card bonus, it’s probably not worth using a credit card that only earns 1x points on everyday purchases to pay your taxes.

Can You Pay State Taxes with a Credit Card?

In addition to paying your federal tax bill with a credit card, most states that collect state income tax will also allow you to pay your state income taxes using a credit card. However, the payment processors will vary by state, and sometimes, the fee will be higher than what you pay for your federal tax return.

In Minnesota, paying your taxes with a card incurs a 1.25% fee for debit card transactions and a 2.15% fee for credit cards. In this situation, it probably wouldn’t be wise to use a credit card for your state income taxes if you’re simply planning to earn points from the spending. Even cards that earn 2x points (or miles) mean you’ll be on the losing end after paying the processing fee. Again, there are times when this will make sense, but in most cases, you’ll be better off paying the old-fashioned way.

However, if your state tax bill is large enough to earn another welcome offer bonus, that could change the equation.

How to Pay Your Taxes with a Credit Card

If you’re a small business owner or have any sort of 1099 income, paying estimated quarterly and annual income taxes is probably quite routine. Instead of mailing a check or paying with an ACH transfer, you can choose one of the IRS’s trusted payment processors to make your payment online with a credit card.

For those with W-2 income, paying taxes with a credit card will likely take some advanced planning to get it right.

If you typically receive money back from the IRS (a tax return), that means you’re already overpaying Uncle Sam with the regular withholding from your paycheck. This isn’t necessarily a bad thing as it ensures you’re paying your fair share of taxes, and getting a return can feel kind of like a bonus … but it’s not great for those looking to earn points and miles by paying with a credit card.

If you plan to pay with a credit card, you’ll have to modify your withholding and reduce the amount of taxes your employer takes out of each paycheck. The best thing to do is use the IRS Tax Withholding Estimator to determine how much you will owe after submitting a new form. The tool will also help you figure out how to fill out your new Form W-4 to appropriately withhold less income for the purpose of paying later.

As soon as you’ve determined how much you owe, you need to have a solid plan on when to pay throughout the year. It’s important to stay organized, especially if you plan on paying on a quarterly basis. As we’re not tax professionals, we highly suggest you consult with one when in doubt, as taxes are serious business.

Once you are at this stage, you’ll go to the IRS website to make your payment quarterly estimated tax payments, as well as your annual payment. If you don’t already have an ID.me account with the IRS, you’ll need to create one to get in and view your secure tax records. From there, it’s as simple as selecting “Make a Payment” from your home screen and choosing your payment method.

Note that paying by card will take you to an external website. This can feel a little uneasy at first but so long as you follow these steps, you’ll be presented with the trusted payment processors that work directly with the IRS. At the time of publication, those processors are Pay1040 and ACI Payment, Inc.

Bottom Line

Paying taxes with a credit card can be a great way to meet a minimum spending requirement for a new credit card account. But if you’re not earning a welcome offer bonus for your spending, you’ll need to run the numbers for yourself to decide.

With tax documents hitting mailboxes soon, so you still have time to prepare for your tax bill, and consider opening a new credit card to earn points on an otherwise painful payment. With a proper strategy, you can earn a big stash of points or miles while paying Uncle Sam.